Which of the following is NOT an example of a typical pre-condition for test execution?

Which of the following is NOT an example of a typical pre-condition for test execution?

Defects are discovered through test analysis and design because…

Defects are discovered through test analysis and design because…

Which of the following would you recommend as the most important field to add?

Scenario “Incident management”

A test team is keeping logs of the incidents that they observe. They use a commonly-available word

processor to write the incident reports in individual files, which are held in shared storage. They

track the incidents, along with some incident details, in a spreadsheet. You have now also been given

the task to identify the key fields for logging the incident reports. So far the following fields have

been in use in the Excel sheet:

– Incident description

– Date

– Author

– Version of the software under test

Which of the following would you recommend as the most important field to add?

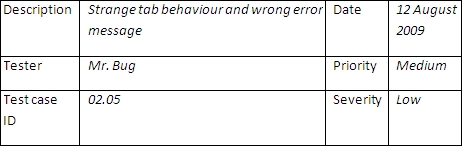

Which THREE major comments would you make having reviewed the following incident report?

Scenario “Incident management”

A test team is keeping logs of the incidents that they observe. They use a commonly-available word

processor to write the incident reports in individual files, which are held in shared storage. They

track the incidents, along with some incident details, in a spreadsheet. You are starting to review

some of the incident reports that have been submitted as a result of test execution. Which THREE

major comments would you make having reviewed the following incident report?

Identify THREE main advantages of this approach to incident management

Scenario “Incident management”

A test team is keeping logs of the incidents that they observe. They use a commonly-available word

processor to write the incident reports in individual files, which are held in shared storage. They

track the incidents, along with some incident details, in a spreadsheet. Identify THREE main

advantages of this approach to incident management.

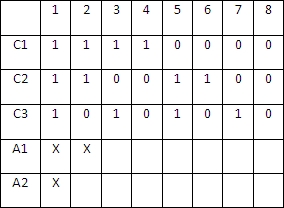

How many cases are left when this decision table is collapsed?

Consider the following decision table, How many cases are left when this decision table is collapsed?

Which of the following could be used to quantify the situation?

It has been suggested to organise a performance test to investigate the third type of complaint.

Which of the following could be used to quantify the situation?

Which technique is most appropriate to use for the suitability test?

For the on-line portal a test will be planned that will focus on suitability. Which technique is most

appropriate to use for the suitability test?

Which of the following statements is NOT correct?

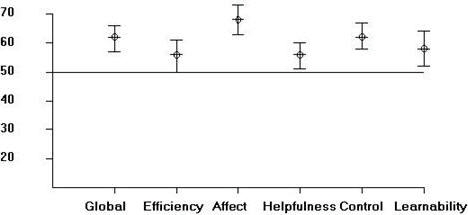

The tax system needs to be updated due to new legislation. For a person with a salary of less than €

20.000 and who is married, the tax needs to be re-calculated. If the person also has more than two

and less than five children, an additional 10% reduction is applicable. A SUMI test has been

performed on the user-interface of the tax system. The resulting SUMI graph is presented below:

Which of the following statements is NOT correct?

Which of the following is a typical defect that boundary value analysis would identify?

Which of the following is a typical defect that boundary value analysis would identify?